Adam Speth2023 President, Northern Wasatch Association of Realtors A new initiative from Utah Gov. Spencer Cox could make homebuying a little easier for those looking to purchase their first house. The governor is proposing a state budget that includes $150 million to build 35,000 starter homes by 2028. “The single greatest threat to our future prosperity, the American Dream and our strong communities is the price of housing,” said Gov. Cox in a press release announcing the proposed budget. “Our kids will never be able to call Utah home if we don’t start building starter homes again. With the goal to build 35,000 new starter homes, the Utah First Homes Program would provide new funds for infrastructure, help for homebuyers …

More building needed to reduce housing shortage

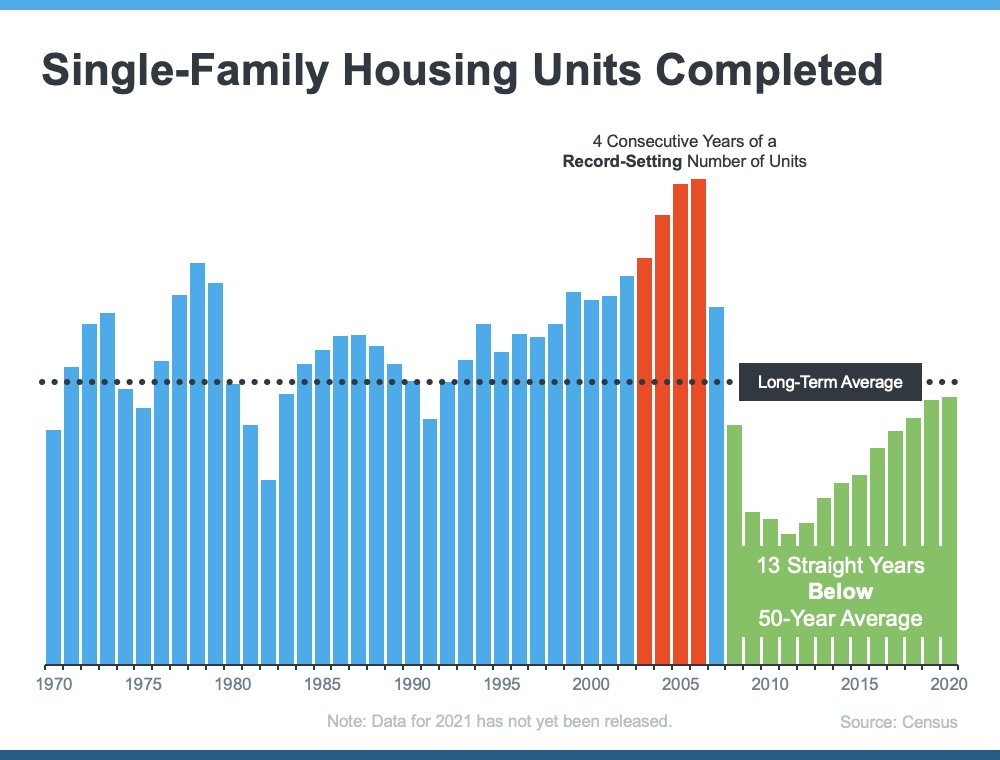

Adam Speth2023 President, Northern Wasatch Association of Realtors Labor shortages, high financing costs, supply challenges and regulatory issues are holding back the home-building industry both in Utah and across the nation. In fact, Utah homebuilding permits fell 19.4% in 2022 — one of the highest drops in the country, according to a report from Point2. In Ogden-Layton, the pullback was even greater with permits down 34% — bad news for our already-historic-low housing inventory problem. Data from the Ivory-Boyer Construction Database shows a similar pattern. Utah residential permits dropped 29% in 2022, and January 2023 residential permits were at the lowest level in the past five years. After a record year for homebuilding in 2021, the pullback is concerning since …

Solving Utah’s Housing Shortage

Adam Speth2023 President, Northern Wasatch Association of Realtors Since 2020, the median home price in Weber, Morgan and Davis counties has increased 43% to $438,000 — rising more than $100,000 in just three years. Although the housing market has slowed in recent months, moderately priced housing is still incredibly difficult to find. As of March 20, there were only 229 houses for sale priced less than $400,000 in the three-county area. While Utah’s housing shortage situation has improved — lacking about 32,000 units currently compared to more than 50,000 in previous years — demand for moderately priced homes continues to exceed the number available, and it’s only getting worse. Realtors worked with the Utah Legislature to address the shortage during …

2023 real estate forecast

Stephanie Taylor2022 President, Northern Wasatch Association of Realtors After a rollercoaster year for the housing market, many are wondering whether we can expect less volatile conditions in 2023. Lawrence Yun, chief economist of the National Association of Realtors, recently provided some answers in a Real Estate Forecast Summit presentation. Yun’s predictions for the U.S. real estate market in 2023 include a 7% decline in U.S. home sales (much lower than the -16% expected for 2022), stable home prices (which will rise in some areas and decline in others) and mortgage rates around 6%. Here are some of the reasons behind his predictions: A home price crash likely isn’t coming Given the strong run-up in home prices and the falling home …