2023 real estate forecast

Stephanie Taylor2022 President, Northern Wasatch Association of Realtors After a rollercoaster year for the housing market, many are wondering whether we can expect less volatile conditions in 2023. Lawrence Yun, chief economist of the National Association of Realtors, recently provided some answers in a Real Estate Forecast Summit presentation. Yun’s predictions for the U.S. real estate market in 2023 include a 7% decline in U.S. home sales (much lower than the -16% expected for 2022), stable home prices (which will rise in some areas and decline in others) and mortgage rates around 6%. Here are some of the reasons behind his predictions: A home price crash likely isn’t coming Given the strong run-up in home prices and the falling home …

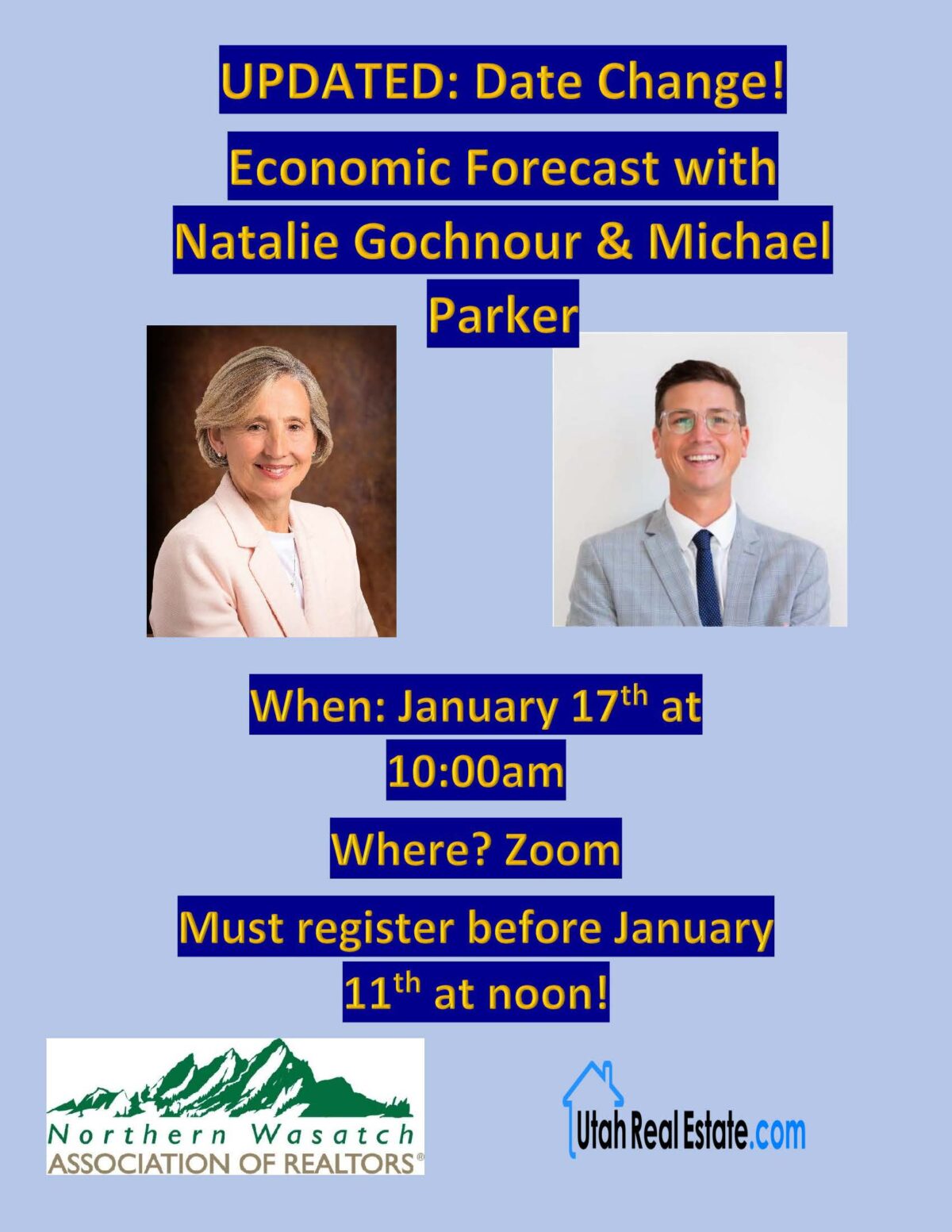

NWAOR Economic Forecast 2023

Register at NWAOR Economic Forecast 2023 (google.com) Speaker Bios Natalie Gochnour serves as an associate dean in the David Eccles School of Business and director of the Kem C. Gardner Policy Institute at the University of Utah. She also serves as the chief economist for the Salt Lake Chamber. In these roles, she provides policy leadership that helps Utah prosper. Gochnour’s experience includes a diverse mix of public service and business experience. During her public service, she advised Utah governors Norm Bangerter, Mike Leavitt, and Olene Walker. She also served as a political appointee in the George W. Bush administration, serving as an associate administrator at the EPA and counselor to the secretary at Health and Human Services. For seven years …

Creative ways to make homebuying more affordable

Stephanie Taylor2022 President, Northern Wasatch Association of Realtors Housing costs are on the rise due to high home prices and interest rates around 7%. In fact, new research from the National Association of Realtors shows payments on a median-priced home have increased 50% in one year. “The median income needed to buy a typical home has risen to $88,300 – that’s almost $40,000 more than it was prior to the start of the pandemic, back in 2019,” said NAR Chief Economist Lawrence Yun. The rising prices have sidelined some buyers, but others are keeping their homeownership dreams alive through creative financing and other buying strategies. Below is a discussion of several non-traditional options to help make homebuying more affordable. Seller …

Frightened of homebuying? 5 important facts

Stephanie Taylor2022 President, Northern Wasatch Association of Realtors Rising interest rates may be a frightening prospect for would-be homebuyers, but there are many reasons why the current housing market isn’t as spooky as it seems — even during the Halloween season. Here are five reasons why you shouldn’t be scared of the housing market. 1. Homebuyers have the best negotiating power in years The days of bidding wars and offers tens of thousands over asking price are over. As a home buyer, you now have negotiating power, much better housing selection and time to shop around before making an offer. There’s also evidence that home prices are beginning to soften. In Weber and Davis counties, the average seller in September …